Webpage Website link

You have education loan financial obligation. You would want to pick a house. Could it be better to pay off the brand new student education loans earliest prior to you start rescuing having a down-payment toward family?

This is exactly a familiar concern to possess You.S. homeowners. On one-hand, settling your student loans before you can save to own a beneficial downpayment you are going to allow you to qualify for a larger home loan, due to the fact you have faster financial obligation. It might together with give you the emotional advantage of understanding that you will be officially out of lower than people figuratively speaking.

Concurrently, would love to begin rescuing to possess property function are stuck once the a tenant for extended. And, property cost, currently large across all the U.S., will have time to wade even higher before you will be ready to pick.

It’s no secret you to definitely scholar personal debt will likely be a hurdle inside conference most other financial specifications. A recent study throughout the Federal Association away from Realtors unearthed that out of basic-date homeowners whom struggled in order to develop a downpayment, nearly 50 % of said college student loans delayed her or him in preserving to own good domestic.

It currently takes lengthened to store a downpayment now than just until the pandemic. Centered on a diagnosis from your home-purchasing business Tomo, inside the August a primary-day homebuyer will need on the 7 decades and you will eleven days to help you help save a great 20% deposit towards a median-valued home. Into the elizabeth consumer would have requisite eight decades and something day.

It is really not simply a pandemic pattern. The time had a need to save your self for an advance payment might have been inching up-over the past twenty years, also. In , the common first-big date homebuyer called for regarding the half a dozen decades to save an effective 20% downpayment.

Couples you to definitely broadening problem with ascending average pupil loans lots and stretched mortgage cost words, along with the best storm out-of contending financial challenges: prioritize paying off pupil financial obligation otherwise rescuing getting a down payment? To determine that’s right for you, address these types of about three issues:

What are your other monetary goals?

Are you willing to get a property before you could pay off their college student finance? The answer, predicated on several financial planners, are this will depend. Them point out that a great student loan balance doesn’t need kill the dreams of homeownership.

Although choice to target saving for property just before you only pay out-of your college loans is certainly one you must make relating to their total monetary lives. Two to three economic wants are the most anyone can work with the at the same time, says Kristi Sullivan, a great Denver financial planner, therefore make certain you founded a powerful economic base before you could initiate saving to own a property.

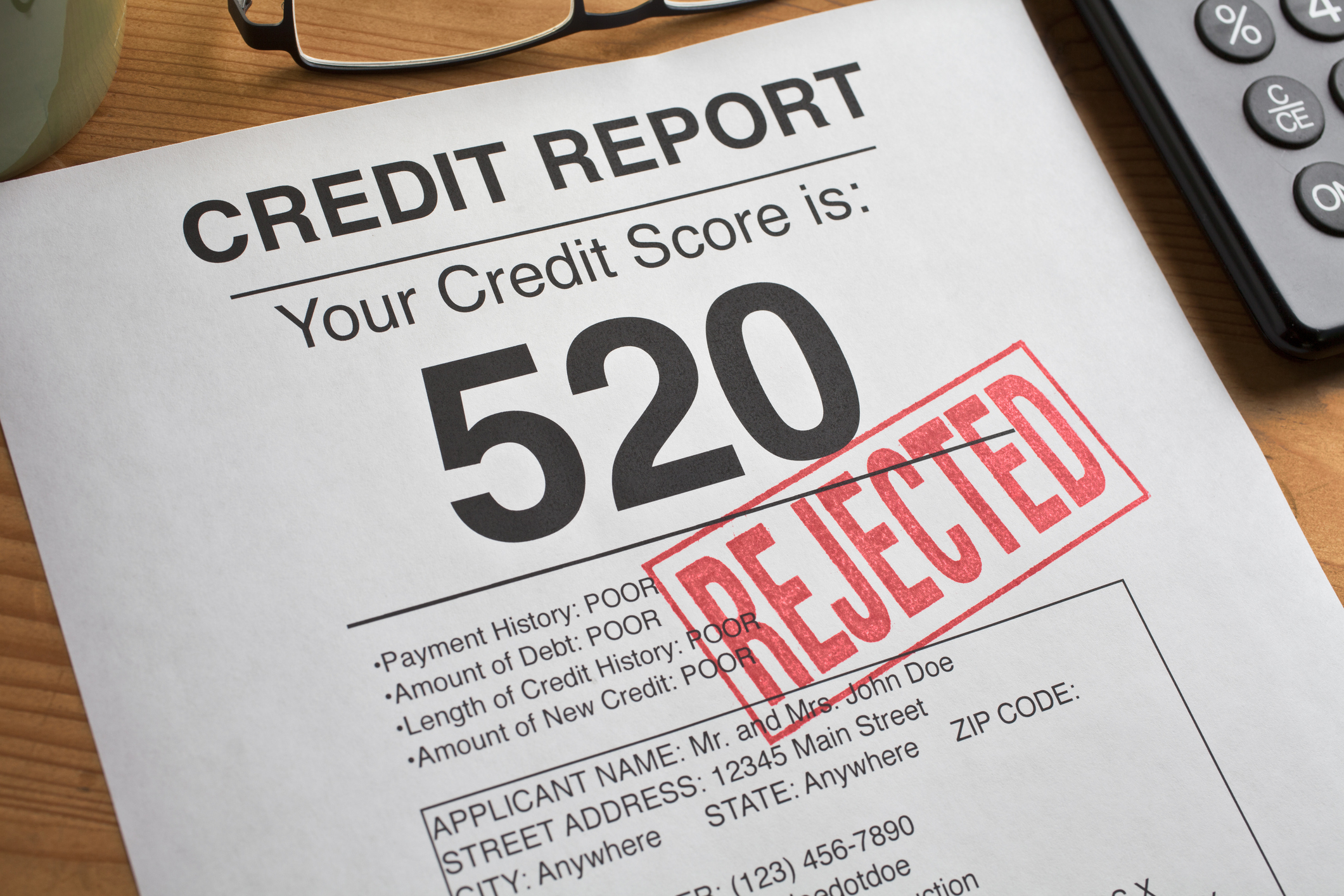

You ought to repay people credit card debt. This loans almost certainly carries a top interest rate than just sometimes the figuratively speaking or home financing, very retire it very first.

Generate a crisis funds, which will include throughout the half a year of the center costs. That it money may see your through a period of jobless, pillow surprise debts, or even help you make use of a rapid opportunity. Place the profit a checking account or certificate out of deposit for which you learn you can log on to once the needed.

Ultimately, initiate otherwise keep rescuing to own advancing years. More you might put away while you’re young, the greater amount of many years your investment have to take advantageous asset of the newest multiplying energy away from substance attract. You really need to at least getting rescuing an amount that enables you to take full advantage of their employer’s matching funds, in the event that’s on offer. That’s free money and supply your an one hundred% price regarding come back, even if they never ever produces another penny.

In the You.S., an average debtor owes on the $29,000 towards the bachelor’s training education loan obligations, That number visits $66,one hundred thousand for master’s values overall, therefore shoots in order to $145,500 for legislation college, $202,eight hundred to have health sciences levels such dental and pharmacy and an excellent whopping $246,one hundred thousand to possess medical college or university, according to National Center for Training Analytics. Away from lower to large, which is a distinction regarding $217,one hundred thousand.

Rates towards the beginner personal debt are very different, as well. Rates into the federally backed obligations for undergraduate amount are the lowest, and you can start around 2.75% so you’re able to 4.66%, based just what season you took him or her out. Scholar school financial obligation sells desire between 5.3% and six.6%, and Together with loans normally manage all the way to 7.6%. Private mortgage rates are often high, anywhere between 3.34% so you can %.

In which the debt falls in bad credit unsecured personal loans guaranteed approval 10000 this those ranges will help influence the newest best bet for you. One or two percentage activities difference between their rate of interest adds up to help you cash during a period of age. Such as for instance, at the step 3%, financing full from $30,100 will cost you $cuatro,860 inside the appeal more ten years, when you find yourself a loan equilibrium of $246,100 carry out rates $39,050.

But at 5%, extent you may be spending on appeal grows to help you $eight,900 with the less equilibrium and you may an excellent $67,a hundred for the larger one to.

To put it differently: In the event your interest is reduced, then there’s shorter damage for the paying the lowest on your own student personal debt if you’re pressing more income to your your own advance payment funds. Nevertheless the so much more you borrowed as well as the highest your rate of interest, the better regarding you are paying off the balance in advance of agenda, even though it indicates it will take your prolonged to save a down-payment.